Data Furnisher

Empowering users to build stronger credit through transparent, data‑driven reporting.

Company

Data Furnisher

Category

FinTech

Industry

Finance

SErvice we provided

UI/UX Design

About the Project

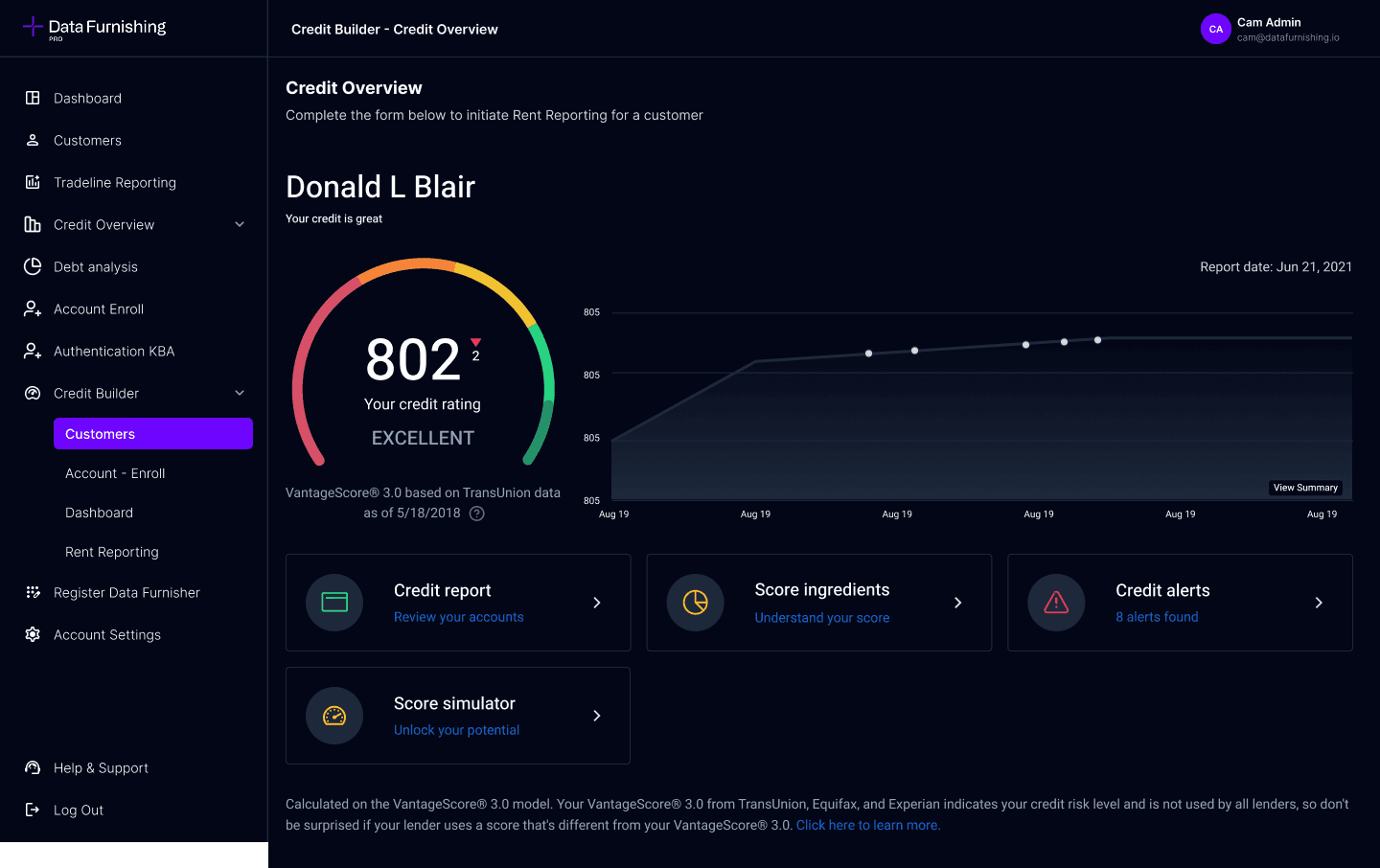

Data Furnisher is a fintech platform that helps individuals and businesses improve their credit scores by securely connecting with authorized credit bureaus. Through data furnishing—where verified financial activity is reported directly to credit bureaus—the platform ensures users’ positive behaviors are accurately reflected in their credit history.As the UI/UX designer, I focused on building trust-driven, compliant, and intuitive experiences for users navigating sensitive financial data. My process included research on credit reporting behavior, regulatory compliance, and user psychology to create transparent and empowering flows.

(01)

Challenge

The challenge was to simplify complex credit processes, minimize user anxiety, and ensure complete clarity while maintaining strict compliance standards.

(02)

Immersion

Understanding user trust factors and credit literacy gaps.

Through research and testing, I uncovered key user needs:

Clarity on how credit scores change over time

Transparent breakdown of data shared with credit bureaus

Simple, secure flows for financial data linking

Guidance for users unfamiliar with credit-building concepts

Visual confidence signals to reinforce data safety

(03)

Design Solution

A transparent, educational platform built around user confidence and compliance.

The interface was designed to balance regulatory requirements with user-friendly structures, ensuring that sensitive credit actions feel safe, understandable, and empowering.

(04)

Feature Highlights

Data Accuracy & Transparency

Data Accuracy & Transparency

Clear visualizations showing credit score status, contributing factors, and historical trends.

Trust-Centered Design

Secure, step-by-step flows with strong reassurance patterns for handling sensitive financial data.

Guided Journeys

Micro-interactions and educational content that explain credit-building strategies in simple terms.

Accessibility & Simplicity

Dashboards designed for both financially savvy users and first-time credit builders.

(05)

Impact

Empowering users to strengthen financial health through clarity and trust.

This project demonstrates how thoughtful UX in fintech can transform complex financial systems into accessible, transparent, and user-controlled experiences—allowing individuals and businesses to actively improve their creditworthiness.

Have a project idea in mind?

Let's get started

We'll schedule a call to discuss your idea. After discovery sessions,

we'll send a proposal, and upon approval, we'll get started.

Not Interested to submit the form?